Transact

Everything to open and manage your account.

It’s simple: What you save on taxes could go towards college savings.

HI529 offers unique tax advantages, including:

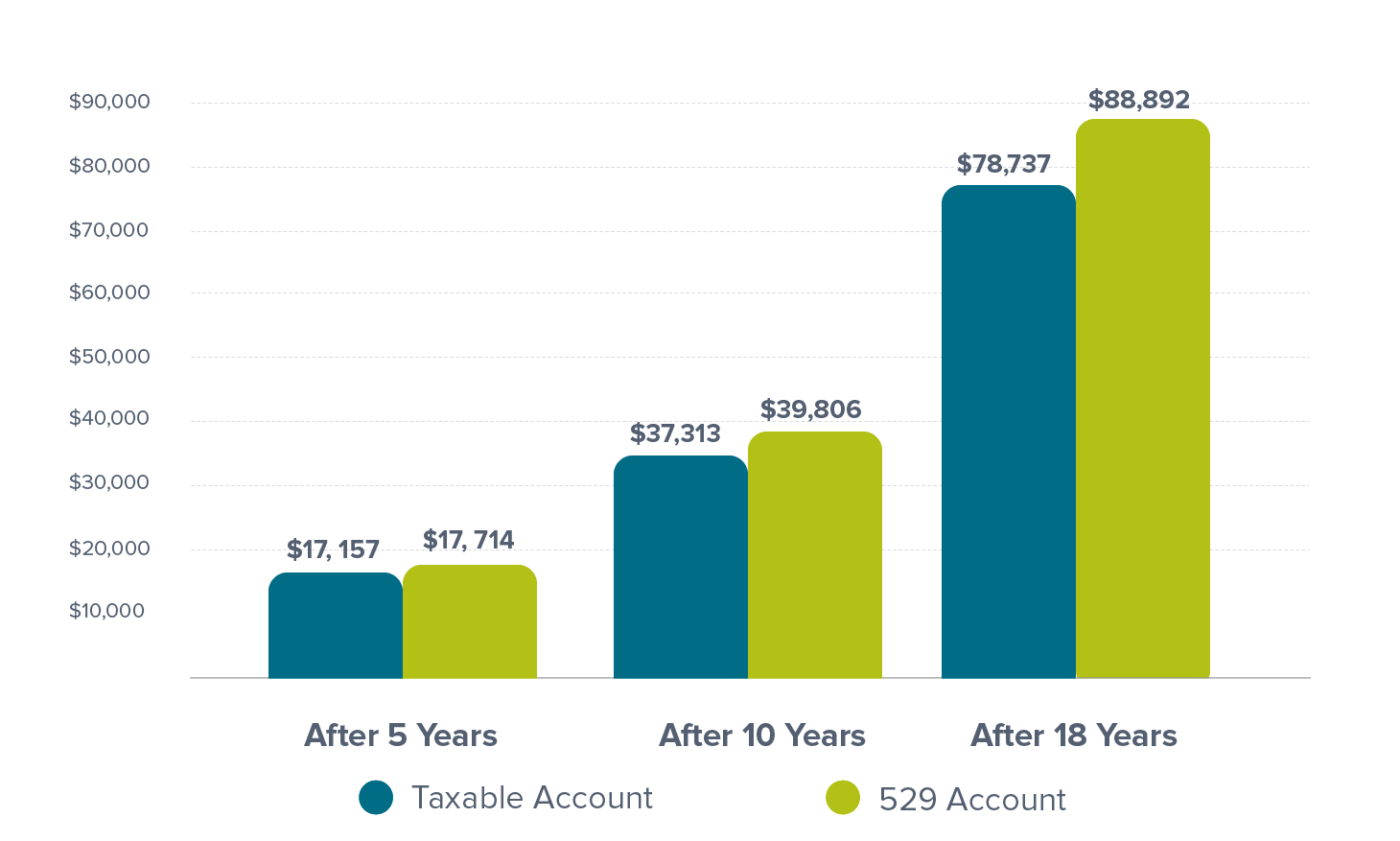

HI529's special tax benefits can make your dollars grow faster. That's because unlike comparable taxable accounts, your 529 contributions can grow free of federal and state taxes. The difference can be significant, as shown in the chart below:

If you open a 529 account with an initial investment of $500 and contribute $250 every month for 18 years, there could be nearly $10,200 more for qualified education costs than the same investment in a taxable account.4 The unique tax advantages of 529 plans can help propel your child further along the path to a college education.

1 Earnings on non-qualified withdrawals are subject to federal income tax and may be subject to a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements. See the Disclosure Booklet for more details on qualified expenses.

2 Since different states have different tax provisions, if you or your beneficiary, as applicable, are not a Hawaii taxpayer, the state(s) where you pay income tax may differ in its state income tax treatment of K-12 tuition expenses. You should consult your own state’s tax laws or your tax advisor for more information on your state’s taxation of withdrawals for K-12 tuition expenses.

3 In the event you do not survive the five-year period, a pro-rated amount will revert back to your taxable estate.

4 Assumptions: $500 initial investment with subsequent monthly investments of $250 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; and taxpayer is in the 24% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon distribution.