Transact

Everything to open and manage your account.

529 plans can be a smart way to balance today's budget with tomorrow's tuition bills. Their special features, from low fees to tax-advantaged investing, can help keep more of your money working for you and your child.

Here's why plans like HI529 could be right for you:

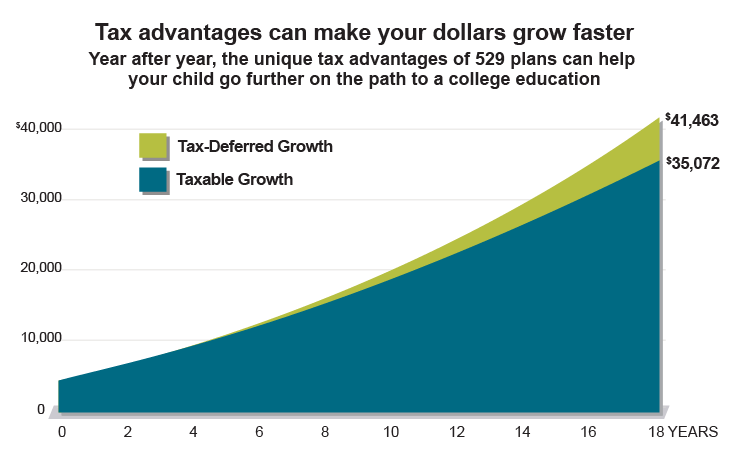

Unlike taxable college savings vehicles, 529 contributions can grow free of federal and state taxes.1 The difference can be significant, as shown in the hypothetical chart below:

If you open a 529 account with an initial investment of $2,500 and contributed $100 every month for 18 years, there could be over $6,300 more for a qualified withdrawal than the same investment in a taxable account.1

Assumptions: $2,500 initial investment with subsequent monthly investments of $100 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; and taxpayer is in the 30% federal income tax bracket for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon distribution.

Choose from:

1Earnings on non-qualified withdrawals are subject to federal income tax and may be subject to a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

2In the event you do not survive the five-year period, a pro-rated amount will revert back to your taxable estate.

3An eligible educational institution is one that is eligible for federal financial aid programs.

4Effective in 2026, the aggregate limit across all 529 plans per student will increase from $10,000 to $20,000.

5Since different states have different tax provisions, if you or your beneficiary, as applicable, are not a Hawaii taxpayer, the state(s) where you pay income tax may differ in its state income tax treatment of K-12 expenses. You should consult your own state’s tax laws or your tax advisor for more information on your state’s taxation of withdrawals for K-12 expenses.